© NZPocketGuide.com

If you have worked in New Zealand, you will have noticed some income tax deducted from your payslip. Well, did you know you can claim some of that income tax back? Of course, you did! That’s why you’re here! This step-by-step guide will show you how to file a tax return in New Zealand.

That’s right, this step might be the only step you need to take to file a tax return in New Zealand because, as of 2019, The Inland Revenue Department (IRD) automatically gives a tax refund to most people working or who have worked in New Zealand each financial year (which begins on 1 April and ends on 31 March).

Automatic tax returns are given if your income is from one of the following:

If you have received income from somewhere not listed above, for instance, you are self-employed, you will have to complete an Individual Tax Return Form (IR3).

© Unsplash

Because most people working (or who have worked) in New Zealand get their tax return automatically, it is essential that you make sure your “myIR Account” on the IRD website is all up to date. Most importantly, make sure that your contact information is up to date (email address, phone number and physical address) and that the bank account that you want the refund to go to is also current.

Yes, you can still file a tax return from New Zealand if you are now overseas. First, update your address on your myIR Account to your current overseas address (follow this how-to on the IRD website or see “Step 8” of this guide). Then, you will be able to change your bank account details to an overseas bank account (follow this how-to on the IRD website or see “Step 8” of this guide).

© Unsplash

Make sure your automatic tax return payment comes through smoothly by doing the following:

© Unsplash

Don’t have a myIR Account? Follow the step-by-step guide to opening a myIR Account below, so you can file a New Zealand tax return online.

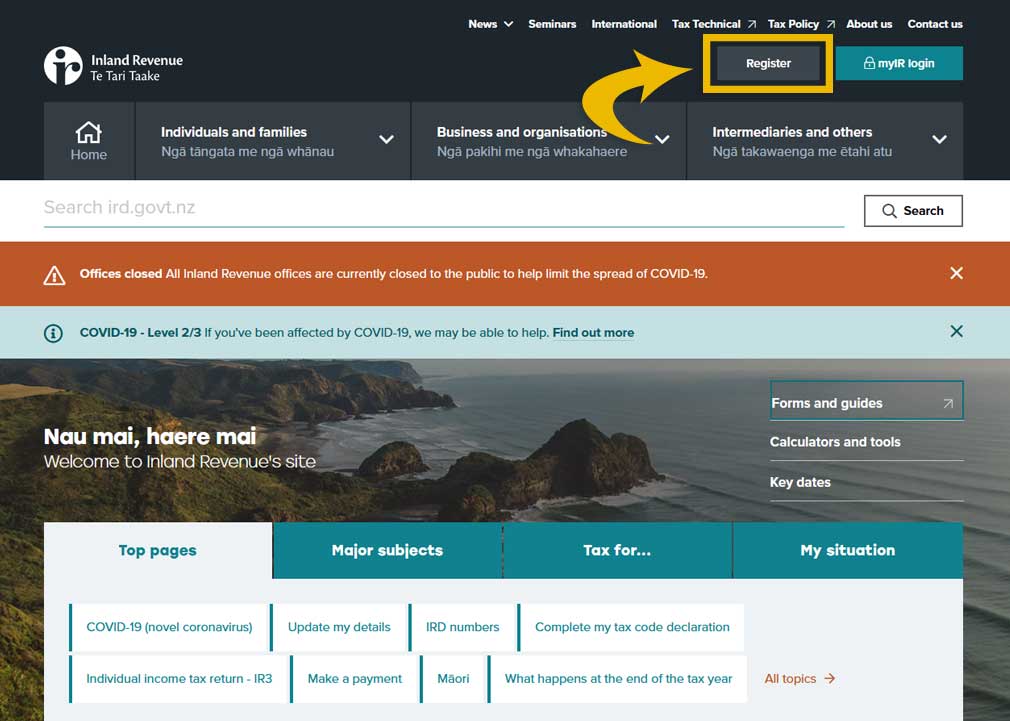

To file for a New Zealand tax return online, first, you need to register for a myIR Account. Click on “Register” on the IRD Homepage.

If you have already registered for a myIR Account, skip to Step 7.

© IRD & NZPocketGuide.com

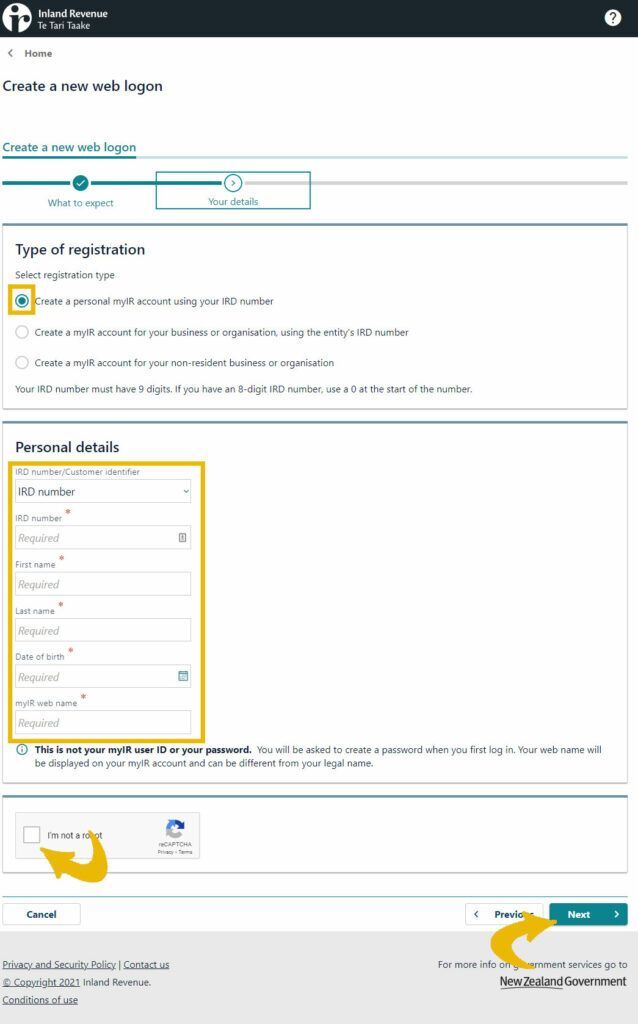

The page you will land on gives you an introduction to creating a myIR account, what you’ll need, when to use your account and more. Click on “Next” and you’ll land on the page displayed below.

On the “Your details” page (i.e. the page screen-captured below), make sure “Create a personal myIR account using an IRD number” is selected.

Under “Personal Details” make sure “IRD number” is selected from the dropdown menu. Then enter your IRD number (you don’t need to type the hyphens as they appear automatically). Your IRD number is your tax number. You can find it on any payslips you have received from work or from any paperwork, emails or text messages you have received from IRD.

You will then need to enter your first name, last name and date of birth. Your first and last name will be automatically entered into the myIR web name. We recommend keeping it the same as your first and last name, but you can change it if you wish. Once all of the fields are completed, click on “I’m not a robot” checkbox and then click “Next“.

© IRD & NZPocketGuide.com

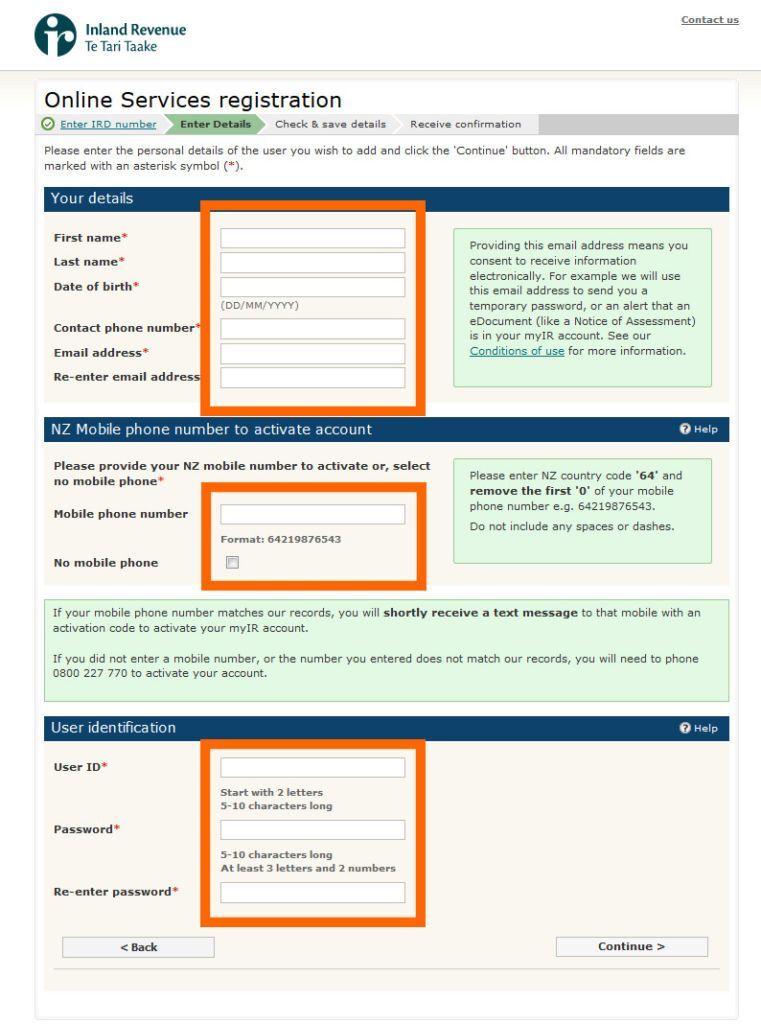

On this page, you will need to complete the fields to complete your myIR account. You’ll need to choose a user ID and password and provide an email address. You may also be required to provide a phone number with the appropriate dial code.

Note the below screenshot is from the old IRD website. What you see on screen may look different from this.

© IRD & NZPocketGuide.com

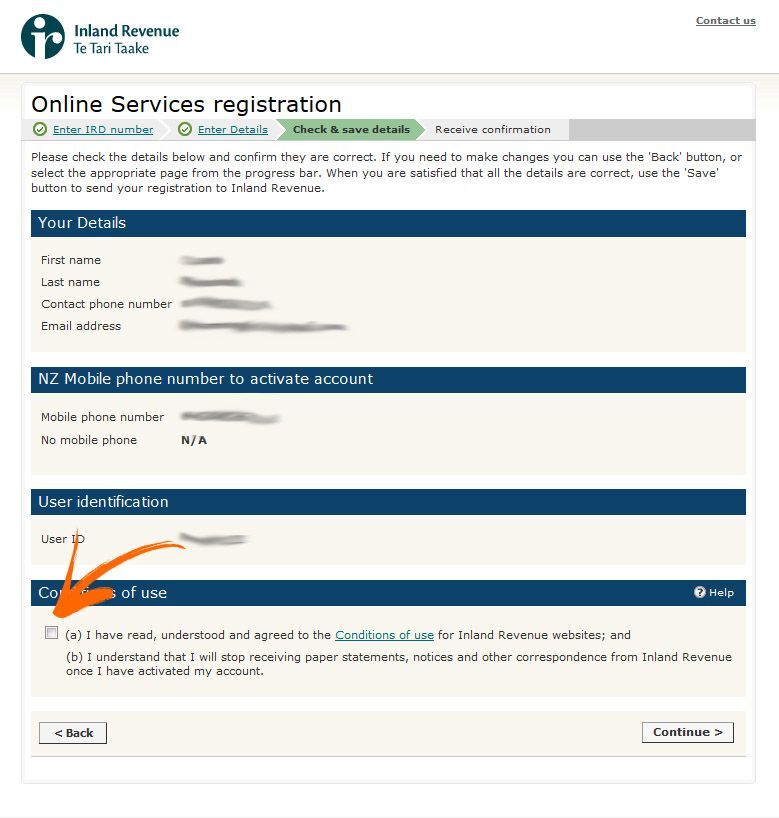

Check your details, click on the box to agree to the conditions of use, and continue.

Note the below screenshot is from the old IRD website. What you see on screen may look different from this.

© IRD & NZPocketGuide.com

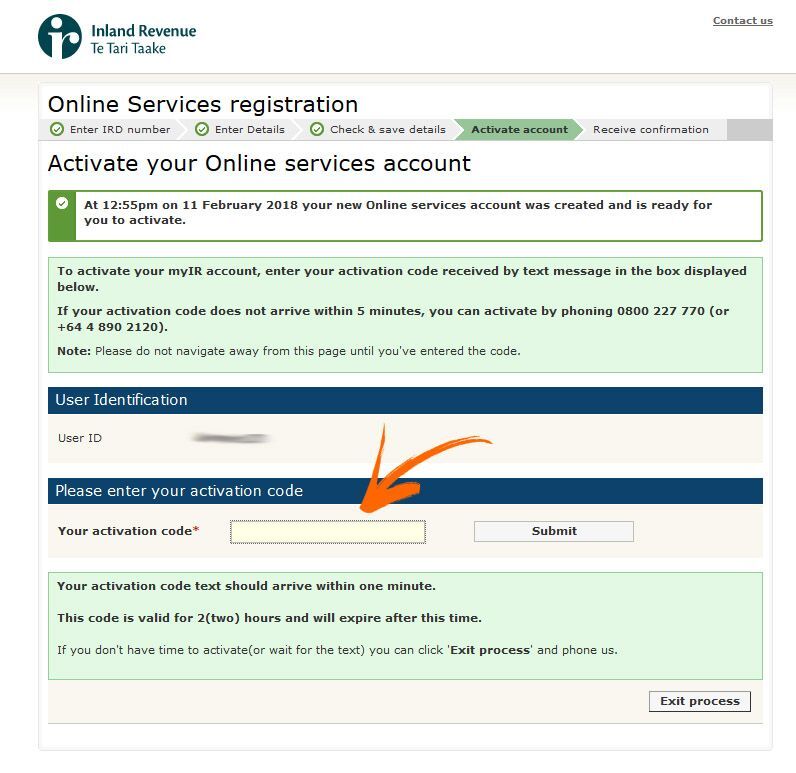

Once the previous page is complete, you will then receive an activation code by email. You have two hours to enter the activation code. Otherwise, click on “end process” and call IRD for an activation code. Enter the activation code and click “submit“.

Note the below screenshot is from the old IRD website. What you see on screen may look different from this.

© IRD & NZPocketGuide.com

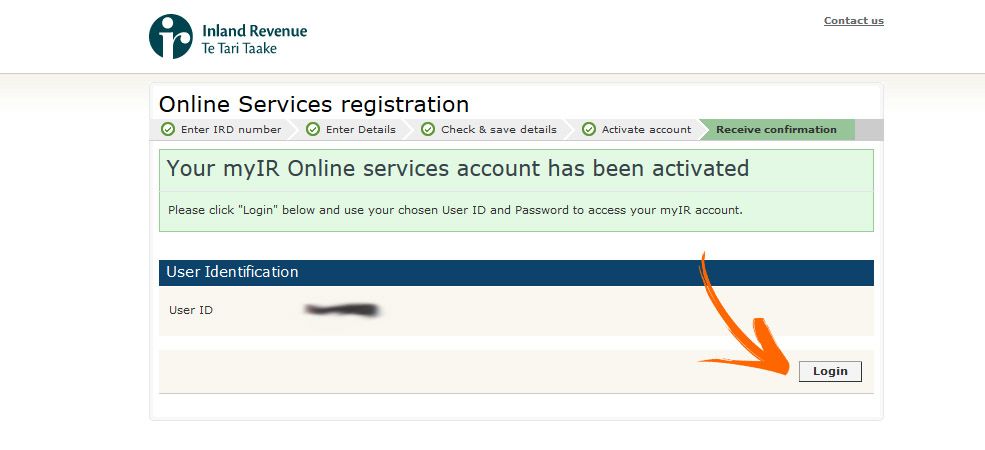

If your activation code is successful, then you should see this page. Click “login“.

Note the below screenshot is from the old IRD website. What you see on screen may look different from this.

© IRD & NZPocketGuide.com

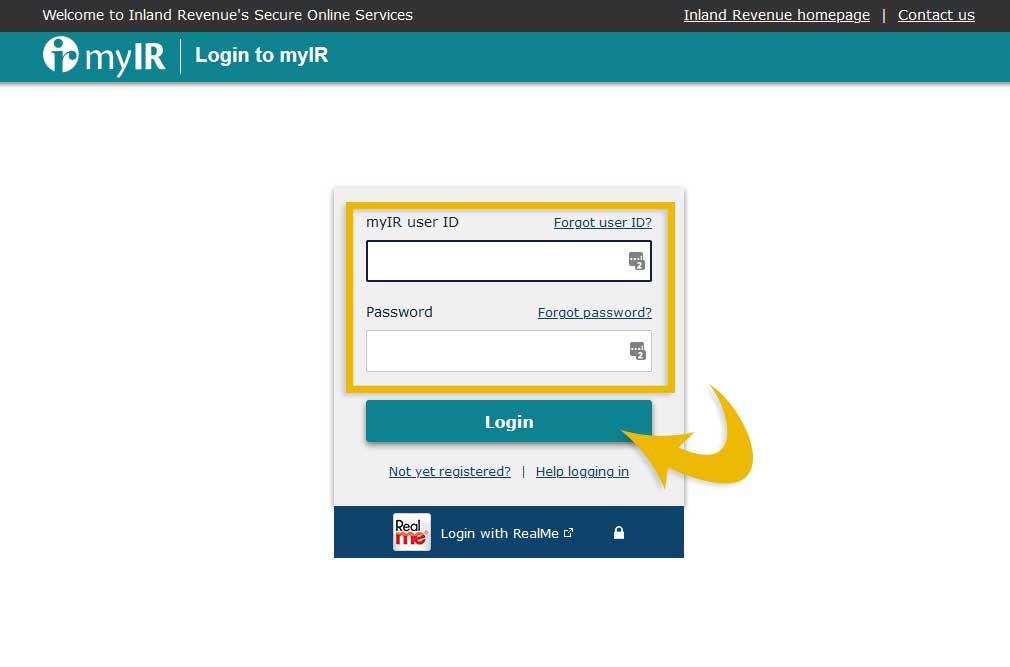

Type in your User ID and password that you created in the previous steps and click “login”.

Well done, you’ve created a myIR Account! Now filing a New Zealand tax return online is going to be so much simpler! The final step you need to do to make sure your tax return comes through at the end of the financial year is to update your bank account details.

© IRD & NZPocketGuide.com

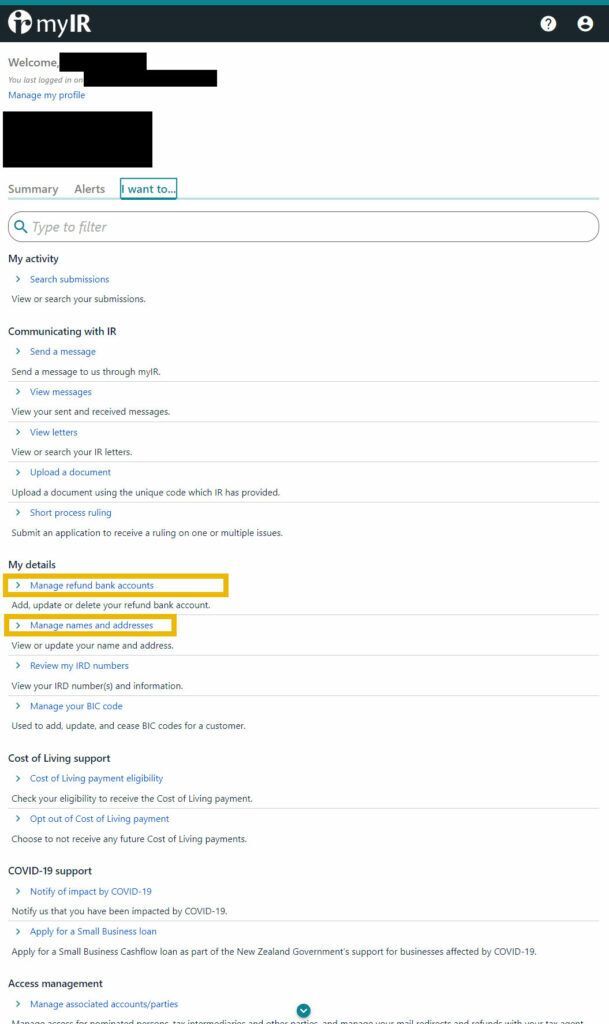

Finally, update your bank account details so that your tax return goes to the right bank account. This can be done simply by clicking/tapping on the “I want to…” tab and selecting “Manage names and addresses” under “My details”. Once your address is current, you can nominate a bank account from the country of your stated address for refunds to be paid into. To insert your bank account details, select “Manage refund bank accounts”.

© IRD & NZPocketGuide.com

If you can’t file a tax return in New Zealand online, for whatever reason, then you can complete the Individual Tax Return Form (IR3) manually via the IRD website. You can also send this form by post, which we detail in How to Get Your Tax Refund in New Zealand.

The best thing to do is to contact IRD directly. On your myIR Account, click on the “I want to…” tab, then under “Communicating with IR” select “Send a message”. Alternatively, you can contact them with the following details:

If all of that feels too overwhelming (we don’t blame you, the guide to complete the form is a 68-page document), you can use a tax return company, like Taxback. They make the whole process much simpler, even if you’re trying to claim a tax return from a few years ago. What’s more, they can speak to you in your own language, have a reasonable fee which is deducted from your tax return (nothing to pay upfront) and can provide support even before you’ve started work in New Zealand.

That’s it for our complete guide on how to file a tax return in New Zealand. For more tax tips, check out the following guides:

Finally, don’t forget to check out our Work Tips & Essentials category for more essential advice.